Chart analysis by Keith Rankin.

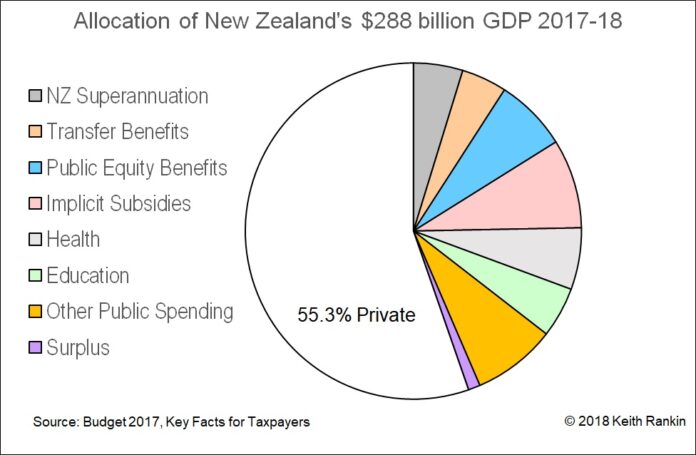

This month’s chart looks at New Zealand’s 2017-18 GDP (of $288 billion). The chart uses official data, with appropriate re-accounting, as presented to this year’s New Zealand Association of Economists’ Conference (also here, and see slides here); and taking note of our need to move from “primitive capitalism” to “economic capitalism” (see article here).

In the chart, the figures for ‘NZ Superannuation’, ‘Transfer Benefits’, ‘Health’, ‘Education’, ‘Other Spending’, and ‘Surplus’ are exactly as in the May 2017 Budget Statement. (I avoided using the 2018 Budget, because the presentation of information for public consumption this year was far too opaque. In previous years, Key Facts for Taxpayers gave a succinct summary of public revenue and expenses, albeit using our time-worn outdated public accounting conventions.)

My innovations have been to redefine Gross Public Revenue – giving a more accurate and intuitive measure of the size of the public hemisphere (refer to my Liberal Mercantilism and Economic Capitalism) – and then to reclassify income tax concessions as ‘Public Equity Benefits’ (refer to my Policy Observatory Report, Public Equity and Tax-Benefit Reform) and to expose the large remaining share of public income as ‘Implicit Subsidies’.

In the pie-chart, the coloured slices together (44.7%) represent the public hemisphere of the 2017-18 New Zealand economy. By subtraction, the remaining 55.3% represents the ‘private hemisphere’. The public hemisphere is calculated as 33% of GDP (gross domestic product, the total economic ‘pie’), plus indirect taxes, plus government income from sources other than taxation. (The true public hemisphere would be closer to 50% of GDP if we added local government rates. In the interests of simplicity, local government has been left out of my picture. I have also excluded Accident Compensation levies.)

Public Equity Benefits represent the accumulation of implicit cash benefits arising from the 10.5%, 17.5% and 30% concessionary rates of personal income tax. These benefits are regressive, and unconditional, presently maxing at $9,080 per year ($175 per week) for individuals in receipt of $70,000 (or more) before tax. Persons receiving $48,000 before tax presently receive an annual Public Equity Benefit of $8,420. (These figures have been – and will be – valid for the entire 2010s’ decade.)

Wearing my accountant’s hat, I am not advocating what benefits people should get; simply I am describing what people do receive, unconditionally, from public revenue. (Most of us receive income from private and public sources.) Like democracy, however (and changing my hat), universal public benefits must be good; the problem is that higher earners get more than their share, just as before 1890 (in democracy’s early years) men of property had more general election votes than other men (and women got no votes at all).

Implicit Subsidies are largely received by organisations and land-owners; many can be classed as corporate welfare. They include the five cents in the dollar discount on company taxation (the statutory company tax rate is 28%, in contrast with the personal tax rate of 33%). They include all other corporate tax concessions. They include the proceeds of tax avoidance and evasion. They also include tax concessions to charities. And they include tax not paid on rent attributable to owner-occupied properties.

Implicit Subsidies are more regressive than are Public Equity Benefits. Though some of them are justifiable, nevertheless we require public accounting standards that make all subsidies explicit.

Good public accounting standards inform good policy. Good capitalism acknowledges both economic hemispheres, private and public. Bad capitalist accounting disguises (even to intelligent people) how underprivileged people receive less than their democratic share of publicly-sourced income. Transparent public hemisphere accounting is the necessary sunlight that disinfects primitive capitalism.

Public Equity Benefits and Implicit Subsidies belong in the public hemisphere, not the private hemisphere.