Analysis by Keith Rankin.

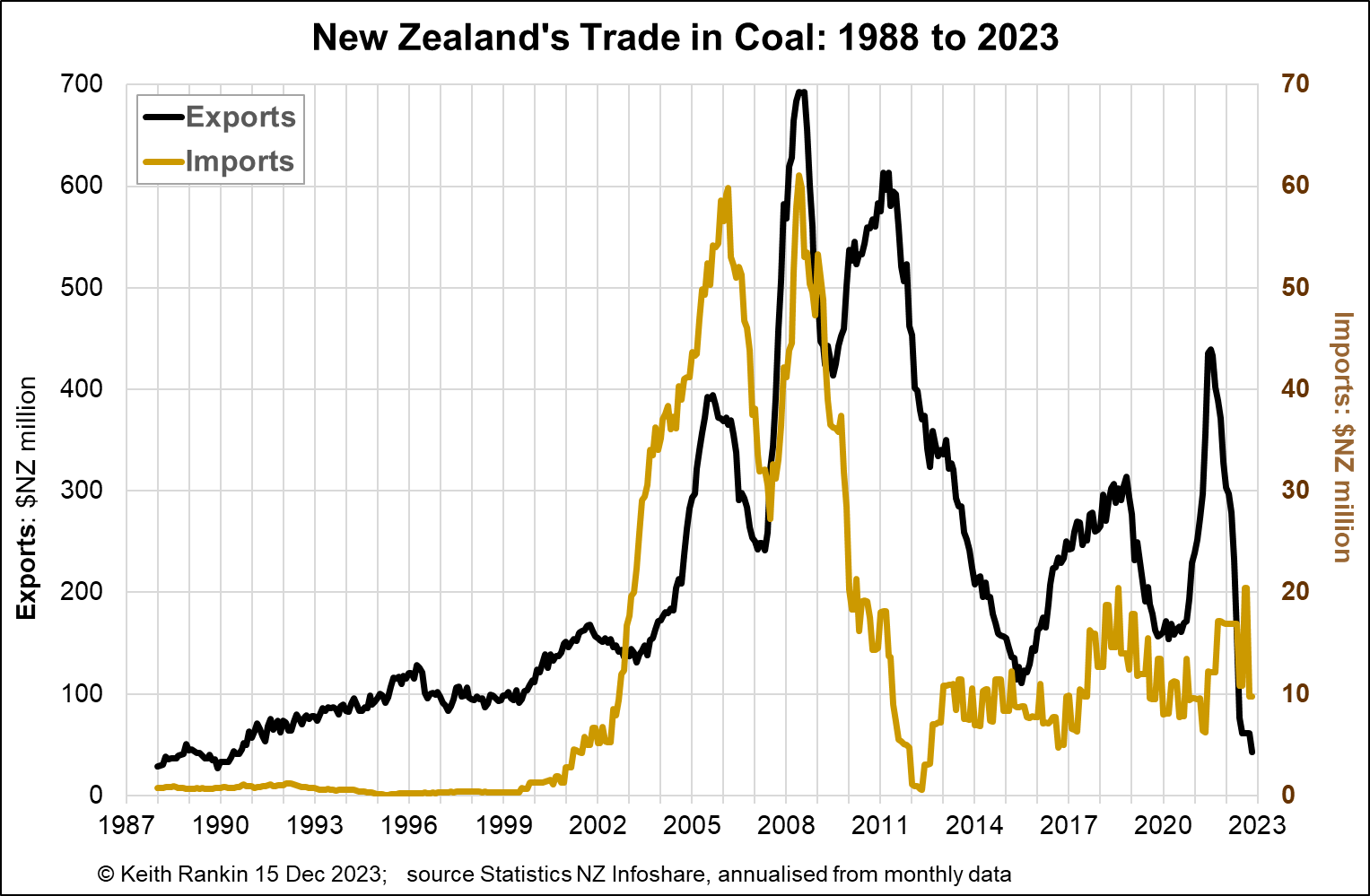

The chart above shows Aotearoa New Zealand’s exports and imports of coal. First, note that the emphasis is on timing, not absolute amounts; Imports have a different scale to Exports. Essentially, imports have been around 10% of exports.

It’s also important to note that most Aotearoan coal is exported, while coal used to generate electricity at the Huntly power station is mainly imported. These are two different grades of coal. So it is to be not unexpected that coal imports will have been high at the same times that coal exports also have been high.

And it’s important to note that these data are for values of coal, not volumes. Values will be affected by fluctuations in world coal prices and by fluctuations in the $NZ exchange rate. (Increases in coal exports from 2000 to 2002 will have reflected the historically low exchange rate then.)

Coal exports actually increased after the November 2010 Pike River explosion; that coalfield was still in development in 2010.

Generally, from 2005 to 2012 the export expansion reflected the world market; noting dips for the 2008 global financial crisis, with a subsequent export of stockpiled coal in 2009. During that coal boom period, more than half New Zealand’s coal exports were to India. There was a resurgence of coal exports to India at the end of the 2010s’ decade.

The lull in 2020/21 reflected to Covid19 crisis. Again, we see an exporting of stockpiles after the crisis eased. In 2023 coal exports plummeted, probably a mix of falling world demand as well as falling New Zealand supply. This is a good sign for global transitioning away from coal, though China’s domestic production and consumption of coal will be rising as it transitions from petrol and diesel cars to electric cars. China will be happy to be using fewer imported fossil fuels.

On the import side, New Zealand’s demand for coal from 2003 to 2020 seems to have reflected the global trend, and it will have reflected a lack of growth in renewable energy generation during the later years of the Clark-led Labour-led government. It was under National that the big fall in coal imports took place.

Coal consumption in New Zealand stabilised in the mid-2010s, but resurged again in 2018, again under a Labour-led government; although, to be fair, 2018 and 2019 mainly reflect economic growth rather than the new government’s priorities.

Coal consumption at Huntly in recent years also reflects drought, meaning less hydro-generation of electricity. There is likely to be a lull in coal imports over the next few months, given that the hydro lakes are full, and the El Niño weather forecast is for a strong contribution from wind generation.

My sense is that increased use of electric vehicles – and increased charging capacity – will lead to another temporary resurgence in coal imports. The 2023 quasi-recession, engineered by the Reserve Bank, may however lead to some offsetting reductions in energy demand. My guess, though, is that there will be a short-lived consumption boom in Aotearoa in 2024 and 2025, as high interest rates pull in hot-money from overseas, holding up the $NZ exchange rate, and leading to a further ‘blow-out’ in New Zealand’s current account deficit; a 30.6 billion dollar annual deficit (7.6% of GDP), slightly less than the record high of nearly 9% of GDP earlier this year.

I look forward to hearing about the new government’s plans for expanded renewable electricity generation, and hope that these plans will not mean the loss of wild rivers such as the Mokihinui. Time will tell; soon, in 2024. This government needs ‘runs on the board’ – outcomes, not just proposals – if it is to survive beyond 2026.

*******

Keith Rankin (keith at rankin dot nz), trained as an economic historian, is a retired lecturer in Economics and Statistics. He lives in Auckland, New Zealand.