Source: The Conversation (Au and NZ) – By John Hawkins, Assistant Professor, School of Politics, Economics and Society, University of Canberra

In a normal year we would be weeks away from the May budget and the official forecasts for the financial year ahead.

This year there will be no official forecasts until October 6, the date of the postponed budget.

It might be just as well.

The finance minister Mathias Cormann says it is nigh impossible to make realistic and credible forecasts in the current environment.

He might also be worried that publishing negative forecasts creates the risk of self-fulfilling prophecies. (It’s an important difference between economic and weather forecasting – predicting rain does not make rain more likely.)But on Tuesday Treasurer Josh Frydenberg saw fit to release details of Treasury forecasts of a 10% rate of unemployment, which he said would have been 15% were it not for the JobKeeper allowance, so such concern can’t be universal.

Even before COVID-19, the Australian economy was tepid, with the bushfires and weak wages growth dampening consumer spending.

Now the cat is out of the bag.

Overnight the International Monetary Fund released shocking updated forecasts. Australia’s 2020 recession will dwarf those that came before it.

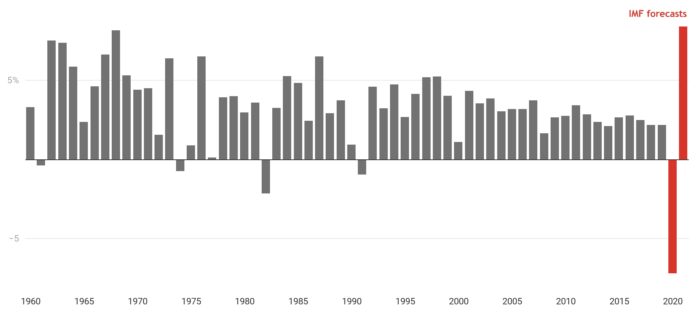

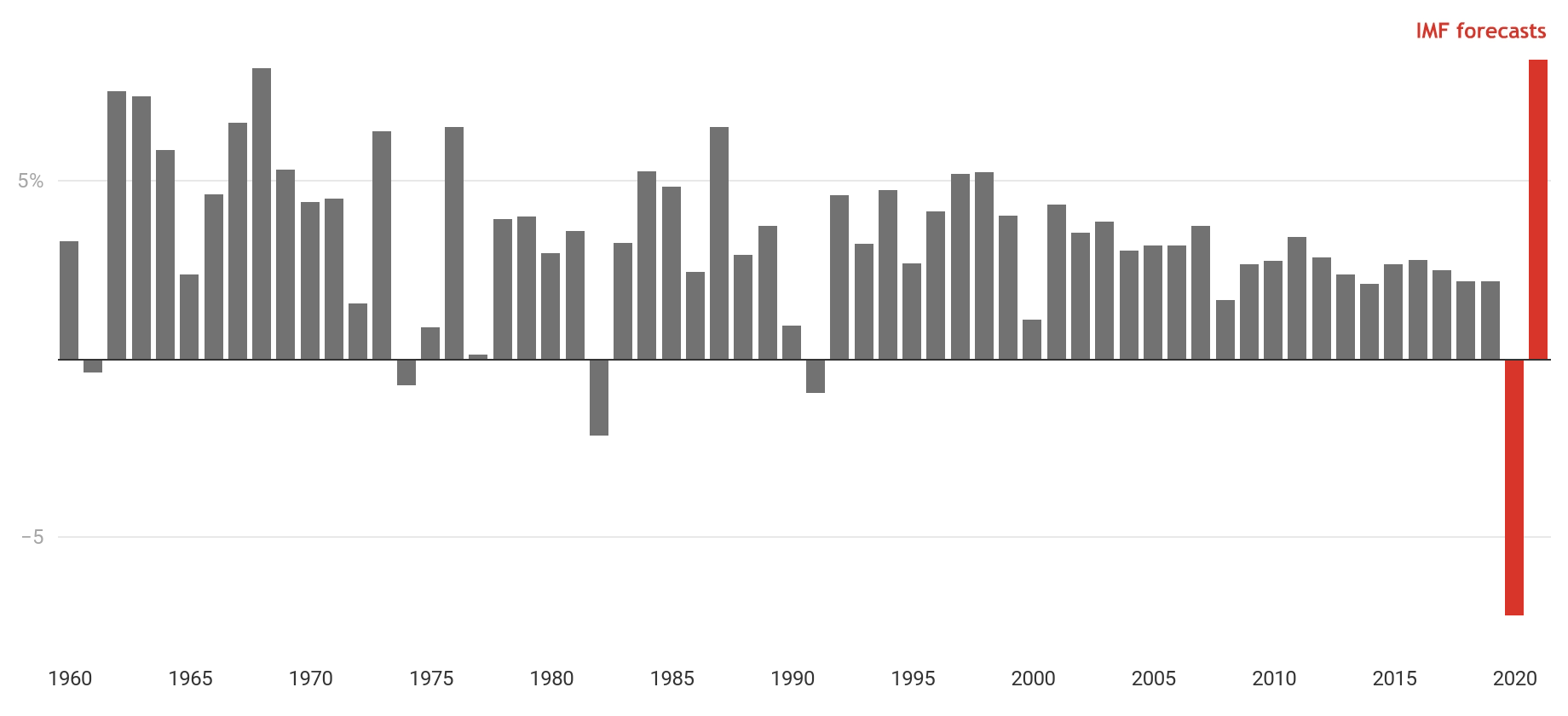

Australian calendar year economic growth

The IMF expects real gross domestic product to shrink by 7.2% throughout 2020.

This is much larger than the falls in real GDP in the early 1980s drought-related recession (2.2% throughout 1982) or “the recession we had to have” (1% in 1991).

To find larger falls it is necessary to go back to the depressions of the 1890s and 1930s.

The Great Depression is one parallel

Australia’s 1890s depression was the result of a global slowdown, the bursting of a speculative property bubble (particularly in Melbourne), bank failures and the prolonged Federation Drought.

Australia’s 1930s Great Depression also followed some speculative excesses but was primarily a response to the global economic slump.

Both depressions predated the acceptance of Keynesian economics in which it was understood that the best way to deal with a decline in private spending was for governments to increase public spending.

Read more: Memories. In 1961 Labor promised to boost the deficit to fight unemployment. The promise won

Instead, back then, governments tried to get their budgets to balance by cutting their spending, making matters worse.

Those depressions occurred well before statistical agencies compiled national accounts.

But a survey of retrospective estimates I did with Robert Ewing suggested that during the Great Depression real GDP may have contracted by 10% to 20%.

The Asian Economic Crisis is another

A more recent parallel to the size of the current fall in Australia’s GDP is the experience of some of our neighbours in the 1997 Asian financial crisis. In 1998 it brought about huge falls in real GDP in Indonesia (13%), Thailand (8%), Malaysia (7%), Hong Kong (6%) and South Korea (5%).

The current contraction has been unusually rapid and it is hoped that the recovery will be too.

The IMF predicts Australia’s GDP will expand by 8.4% in 2021 after falling 7.2% in 2020. It believes we are in the worst of the recession now and the recovery will begin in the September quarter that starts in July.

In year-average terms that understate the size of swings the IMF expects real GDP to shrink 6.7% in 2020 compared with 2019 and then to grow 6.1% in 2021 compared to 2020.

Read more: The next employment challenge from coronavirus: how to help the young

It has revised down its forecast for global growth this year from an increase of 3% to a contraction of 3%. (By contrast, during the global financial crisis global GDP slipped by only 0.1%)

What it terms the “Great Lockdown” is the worst global economic scenario since the Great Depression.

Worse outcomes “possible, even likely”

The US economy should contract 5.9% this year before bouncing back 4.7% in 2021. China’s economy should barely grow in 2020 (1.2%) before bouncing back 9.2% in 2021.

Output and incomes in emerging economies are predicted to return to pre-pandemic levels in the second half of the year. The advanced economies generally won’t return to where they were until the end of 2021.

These are forecasts that might prove optimistic. Depending on conditions and programmes in place in each country, it is likely many business will not survive and many consumers will decide to remain cautious about their spending for some time.

IMF chief economist Gita Gopinath warns

much worse growth outcomes are possible and may be even likely – this would follow if the pandemic and containment measures last longer, emerging and developing economies are even more severely hit, tight financial conditions persist, or if widespread scarring effects emerge due to firm closures and extended unemployment.

Rarely has the trajectory of a downturn been harder to forecast.

Much will depend on the virus itself, on the way in which countries adjust their restrictions to deal with it, and on us. At the moment few of us are feeling good.

– ref. How will the coronavirus recession compare with the worst in Australia’s history? – https://theconversation.com/how-will-the-coronavirus-recession-compare-with-the-worst-in-australias-history-136379