Source: The Conversation (Au and NZ) – By Dan Andrews, Visiting Fellow and Director – Micro heterogeneity and Macroeconomic Performance program, Crawford School of Public Policy, Australian National University

Shutterstock

Australia has long had far less competition in consumer markets than the US.

New research from the e61 Institute finds that in all but one of 17 broad industry divisions identified by the Australian Bureau of Statistics, Australian industries are on average more concentrated than their counterparts in the United States.

The measure used is “CR4” – the market share of the top four firms.

In 2017, the most recent year for which we could obtain comparable figures, Australia was far more prone to high levels of market concentration, with the top four firms accounting for 80% of some markets and averaging more than 60% across some industry categories.

Average concentration across industry groups, Australia versus United States

Market share of the top four firms, per cent

Importantly, we find market concentration in Australia increasing over time.

Between 2006 and 2020 Australia’s average CR4 measure of concentration increased 3 percentage points, with notable increases in industries that initially had a moderate level of concentration, such as retail and transport.

Concentrated industries don’t welcome new entrants

To be sure, concentrated does not always mean that competition is lacking, especially if there is credible threat of being displaced by dynamic upstarts.

But we found that in highly concentrated industries the four largest firms rarely got dislodged from their top positions over the 14 years between 2007 and 2021.

And those industries that experienced a rise in concentration over the seven years to 2014 recorded a decline in new firm entry over the following seven years.

This might mean we have as many as 6,300 fewer employing firms than we would have, giving Australian workers fewer employment options and suppressing real wage growth. And given that young firms are more innovative, it might mean lower productivity growth.

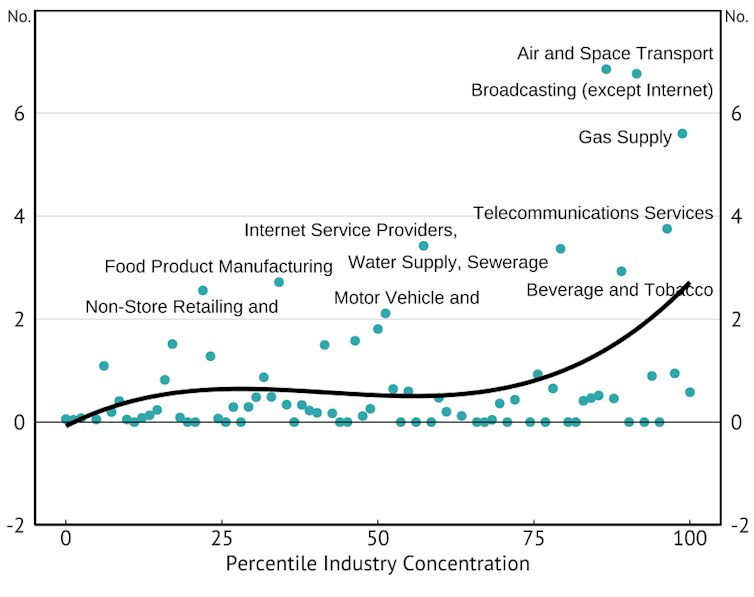

Concentrated industries break rules more often

Ranking Australian industries by their average concentration, we found the most concentrated had the most infringement notices and enforceable undertakings issued by the Australian Competition and Consumer Commission.

The airline industry, which is famously concentrated, has been hit with 12 such notices and enforceable undertakings over the past 30 years compared to only four for the accommodation industry.

ACCC infringement notices and undertakings versus industry concentration

ABC, ACCC, e61

Concentration means higher prices

To explore the impact of market concentration on prices, we examined margins between retail and wholesale petrol prices in Brisbane and the Gold Coast and their relationship to the number of competing petrol stations within three kilometres.

We found that where petrol stations faced less competition they tended to charge higher margins, and that when wholesale prices rose, they appeared to be quicker in passing on this cost to consumers to maintain margins.

Competitors within 3 kilometres versus average petrol margins

Concentration is happening more quietly

Whereas in the US large mergers have to be reported to regulators, in Australia mergers are more like marriages.

Just as you don’t have to tell your family you are getting married, you don’t have to notify the Australian Competition and Consumer Commission you are about to merge with a competitor.

Companies are encouraged to notify the ACCC if the merged parties make either substitutes or complements and the merged firm will have a market share of more than 20%, but that is a guideline rather than a requirement, and the guidance was relaxed in 2008.

If you are high-profile enough to be listed on the Australian Securities Exchange, the ACCC is going to find out anyway through the media (ASX companies have to disclose significant acquisitions), so in practice most companies planning large mergers ask for the ACCC’s blessing ahead of time to avoid embarrassment.

Read more:

Are mergers harming consumers? We won’t know if we don’t check

That means while voluntary notification works well enough for bringing royal-wedding-style mergers to the ACCC’s attention, Vegas-style elopements can go undetected.

Although these small transactions can seem innocuous, their collective impact can be significant. In the US, it is estimated transactions too small to be reported account for 28–47% of the increase in concentration between 2022 and 2016.

In Australia, there is a risk that many of these transactions are going undetected.

e61 has found the number of private mergers (not reported to public financial markets) reviewed by the ACCC has plummeted since the ACCC relaxed the reporting guidelines, from 55 in 2006 to just 12 in 2022

Number of private mergers reviewed by the ACCC per year

The head of the Competition and Consumer Commission Gina Cass-Gottlieb told the National Press Club this year she wanted Australia to move away from voluntary notifications to formal clearances of the kind required overseas where there was

-

a mandatory requirement to notify the ACCC of mergers above specified thresholds

-

a requirement for transactions to be suspended from completion prior to ACCC clearance

Parties proposing a non-contentious merger could apply for a notification waiver that, if granted, would mean they wouldn’t need to make a full formal application and the proposal could be dealt with quickly.

Read more:

Cartels caught ripping off consumers should be hit with bigger fines

Cass-Gottlieb said businesses were increasingly pushing the boundaries of the informal system, giving the ACCC late, incomplete, or incorrect information, and threatening to complete their transactions before it completed its reviews.

At times overseas authorities knew about proposed transactions involving Australian companies before the Australian authorities.

Our research finds that not only are Australian industries concentrated and becoming more so, but mergers might be increasingly flying under the radar.

The government has announced a review of competition policy that will include a review of merger laws as well as non-compete clauses. Our research suggests there’s a strong economic case for taking action on both fronts.

Read more:

1 in 5 Australian workers have non-compete clauses: new survey

![]()

Dan Andrews is affiliated with the e61 Institute.

Elyse Dwyer is affiliated with the e61 Institute

– ref. Flying under the radar: Australia’s silent and growing competition crisis – https://theconversation.com/flying-under-the-radar-australias-silent-and-growing-competition-crisis-212116