Source: The Conversation (Au and NZ) – By Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

Cutting petrol tax to bring down the cost of living used to be the political version of a joke. Failed US presidential candidates John McCain and Hillary Clinton both tried it in 2008. Their bipartisan advocacy of a “summer gas tax holiday” was derided as dumb, a turkey and a “metaphor for the entire campaign”.

When 230 economists released a letter opposing it in 2008, Clinton said: “I’ll tell you what, I’m not going to put my lot in with economists”.

Her opponent for her party’s nomination, Barack Obama, labelled it a gimmick and went on to win both the nomination and the presidency.

But it isn’t being treated as a joke now. There’s talk about it in the US, New Zealand has just cut in its fuel excise 25 cents to ease cost of living pressures, and Australia is considering a budget measure along the same lines.

What has happened to the price of petrol is shocking. In capital cities the unleaded price is about A$2.18, up from $1.60 at the start of the year. That means that whereas it might have cost $80 to fill up a Toyota Corolla at the start of the year, it now costs one third as much again – $109.If you fill up fortnightly, as many people do, the extra impost is greater than if the Reserve Bank lifted its cash rate by 0.25% and pushed up the cost of payments on your mortgage.

Read more:

As petrol prices rise, will carbon emissions come down?

If you own an SUV, by now Australia’s biggest selling type of new car, the extra impost will be greater. And (as with interest rates) there’s every chance petrol prices will climb further.

In New Zealand, where petrol costs more than NZ$3 per litre (A$2.80) the government has cut petrol excise by 25 cents per litre for three months, in the hope that by then the worst effects of the Russia-Ukraine war will have passed.

Australia taxes petrol lightly

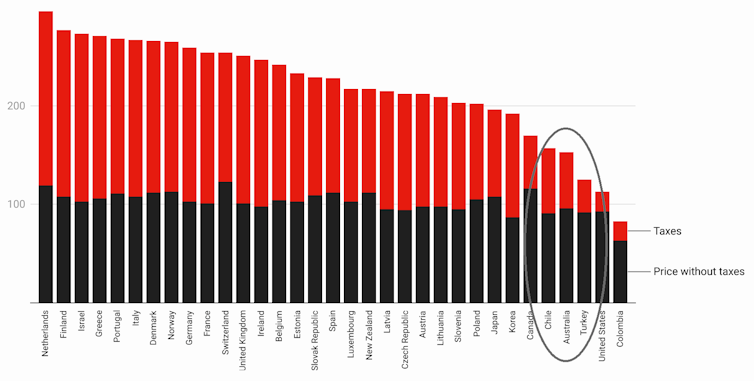

Eagle-eyed readers will have noticed that even with the cut, New Zealand petrol prices will still be way above Australia’s. That’s because, like most developed nations, New Zealand charges more in tax for using roads than does Australia.

Until the cut on Tuesday, New Zealand petrol excise was a touch over NZ$0.77 per litre (A$0.72) compared to around A$0.43 in

Australia.

Low by international standards

Department of Industry, Science, Energy and Resources

The goods and services tax charged on top of that in both nations brings the NZ excise to about NZ$0.89 per litre (A$0.83) compared to Australia’s A$0.48.

If these figures sound low, it’s because the price of petrol has soared. One of the peculiarities of taxes that are set in cents per litre (climbing only with inflation) is that when the petrol price jumps, the tax as a proportion of the total price shrinks.

Benjamin McKay/AAP

A year ago fuel excises accounted for 40% of the cost of New Zealand petrol, and 35% of the cost of Australian petrol. At 28% and 22%, they’ve become self-cutting.

If we abolished fuel excise altogether, cutting the Australian unleaded price 22%, we would only bring the price back to where it was five weeks ago.

And then (as I imagine will happen in New Zealand after three months) the government would find it hard to reintroduce it.

It is finding it difficult to end the $1,080 low and middle earner tax break that was meant to finish two years ago.

The mess it has got itself in by hinting that it will cut the excise and by not ending the A$7.8 billion per year low and middle earner offset hint at a way out.

The offset is poorly designed. It is paid out as a tax refund after the end of each financial year, making it the opposite of the “stimulus measure” Treasurer Josh Frydenberg said it was when he last extended it. If he extends it again for the coming financial year, it won’t get paid out until the second half of 2023.

Read more:

This pointless $1,080 tax break should have ended years ago – but has become hard to stop

The petrol component of the fuel excise brings in A$5.8 billion per year. The government might be able to hang on to that and use the A$7.8 billion that would have been spent on the offset to support people now when they need it and when petrol prices are high, rather than a year into the future when they might not be.

The A$7.8 billion would be directed to Australia’s lowest earners, the ones who are being hit hardest by the horrendous petrol prices. Low earners (the bottom 40%) on average spend more than 3% of their income on petrol. High earners spend less than 2%.

Support shouldn’t be tied to petrol use

The direct support to low earners should be delivered in cash rather than as a subsidy to petrol prices. Recipients would be able to spend it on petrol should they need to, but would be able to spend it on other things.

If it was delivered as a petrol subsidy it would go disproportionately to the highest earning households for whom high petrol prices are a mere annoyance. High income households spend more on petrol in absolute terms (on average 50% more) than low income households.

Read more:

High petrol prices hurt, but cutting excise would harm energy security

If it is delivered as cash rather than a petrol subsidy it won’t blunt the push that high prices give for people will switch to more efficient cars and use petrol less by doing things such as working more from home.

It’s hard to find a case for a cut in Australia’s petrol tax, but it is easy to create a mechanism to help the people high prices are hurting. The budget is due in a fortnight.

![]()

Peter Martin does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

– ref. It’s hard to find a case for a cut in petrol tax – there are other things the budget can do – https://theconversation.com/its-hard-to-find-a-case-for-a-cut-in-petrol-tax-there-are-other-things-the-budget-can-do-179272